Tuesday 24 October, 2023

Inflation and How it Affects Energy Pricing

The global pandemic from a few years ago threw the world economy into turmoil. Not only did many businesses shut down both temporarily (and some permanently), but the supply chain was log-jammed. This affected each and every market globally. It was the equivalent to someone grabbing and pulling the emergency brake on a high-speed train. Basically, it has repercussions which we still feel today.

The way in which leaders from around the world, and more specifically our own government, handled the crisis seemed to add fuel to the fire. They injected economies with money created out of thin air, trillions of dollars in fact. More money in a closed system where less work is being done is the perfect recipe for inflation. And we saw plenty of it.

At one point the year-over-year inflation was in the mid-double digits. It has since crept back down to mid single digits. But, we are not out of the woods yet. Fuel and heating oil, like every commodity, was hit hard by inflation. The prices crept upwards for some time. People looking to fill their home oil tanks dreaded receiving the bill.

World Wide Conflict and How it Affects Pricing

The western world depends on oil imports from other countries. Unfortunately, some of those countries are at odds with the western world. Countries like Russia, Venezuela & some in the middle-east have a love/hate relationship with the United States. They hate the U.S. but love selling us oil.

It can be pondered as to what prices would be if the United States were on better terms with some or all of these countries. Would the price be affected? Would the price per barrel remain the same or would it be cheaper?

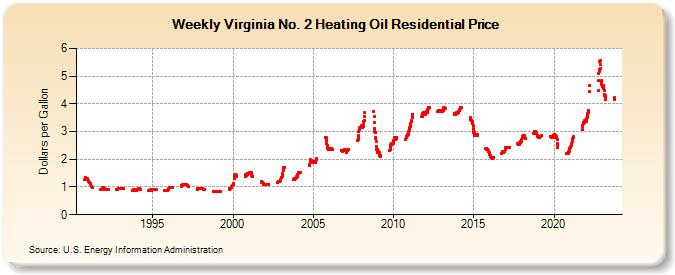

Current Pricing of Heating Oil in the Virginia Region

As you can see from the chart provided by eia.gov, the price hit an all-time high last year. It has eased some but many speculate if it will ease further or spike again. We are anticipating a return to 2012-13 prices and have hopes that it either levels off there or even drops significantly.

Tom Kloza, global head of energy analysis at Oil Price Information Service, recently had this to say: “I think we might find ourselves at the end of November with the wolf at the door”. These are not exactly encouraging words but nothing is written in stone. Our advice is to purchase your oil now in case Mr. Kloza is correct.

|

0